SR&ED Tax Credit

- Overview

- Innovation for a better Canada

- SR&ED Eligible Companies & What They Can Earn

- Our SR&ED Services

- Why Ayming as your SR&ED Partner?

Overview

The Scientific Research & Experimental Development (SR&ED) Tax Credit Program offers some of the most lucrative tax credits in the world. This program provides more than $3 billion to over 20,000 claimants annually. This makes it the single largest federal program to support innovation in Canada. Administered through the Canada Revenue Agency (CRA), this tax incentive provides funding for companies performing Research & Development (R&D) work in Canada. These tax incentives come in three forms: an income tax deduction, an investment tax credit (ITC), and in many cases, a refund.

A common misconception about the SR&ED Tax Credit program is that you need to be a state-of-the-art laboratory in order to qualify. In reality, almost any company of any size can qualify to receive SR&ED. This is mainly because R&D work can be easily integrated into everyday business activities. If your employees are trying to solve a technological problem with no readily available solution, odds are their work is eligible for SR&ED tax credits.

You may be already doing work that qualifies for SR&ED, such as:

- Developing a new manufacturing process or product.

- Developing a new software for your business or for your client.

- Focusing on improving existing products or processes.

- Incurring costs related to a project, prototype or process that is incomplete because of technical problems.

- Improving your competitive advantage.

- Developing innovative solutions.

- Improving current technology.

- Research & development.

- Activities relating to engineering, design, modelling, data collection, testing or new development work of any kind.

Innovation for a Better Canada

Canada is in a global innovation race. We are competing with countries around the world for the most talented people, the newest technologies, and the fastest-growing companies. Jobs and prosperity will go to the countries that succeed in those three areas.

The SR&ED Tax Credit program provides billions of dollars in support to Canadian businesses of all sizes and varying industries.

Call us today to see how our Canadian team of experts with over 200 years of combined SR&ED experience can assist you.

SR&ED Tax Credit | Eligible Companies & What They Can Earn

- CCPC (Canadian Controlled Private Corporation): A CCPC can earn a refundable investment tax credit (ITC) at the enhanced rate of 35% on qualified SR&ED expenditures of $3 million. They can also earn a non-refundable ITC at the basic rate of 15% on an amount over $3 million. Additionally, if you are a CCPC that also meets the definition of a qualifying corporation, you also earn a refundable ITC at the basic rate of 15% on an amount over $3 million; and 40% of the ITC can be refunded.

- Other Corporations: Other corporations can earn a non-refundable ITC at the basic rate of 15% on qualified SR&ED expenditures. The ITC can be used to reduce taxes payable.

- Individuals (Proprietorships) or Trusts: Proprietorships and trusts can earn a refundable ITC at the basic rate of 15% on qualified SR&ED expenditures. They must apply the ITC against taxes payable before the CRA can refund 40% of the unclaimed balance of ITCs earned in the year.

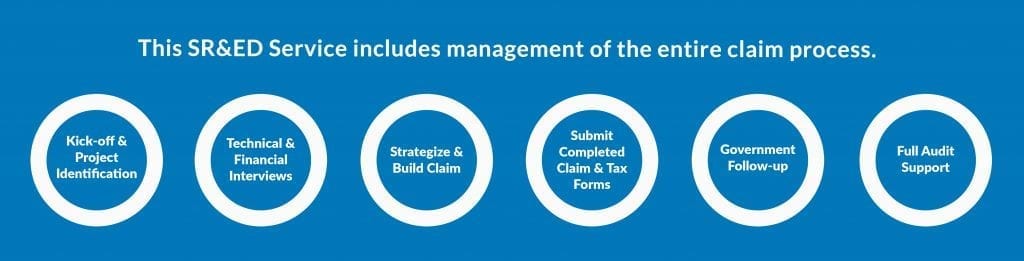

Our SR&ED Tax Credit Services

Ayming Canada’s team of SR&ED experts boast over 200 years of combined experience. They are best positioned to ensure that you are not leaving any money on the table, while submitting strong and defendable claims.

Ayming offers flexible engagement options. Ayming gives you the ability to choose the best service that meets your needs. We can tailor our agreements depending on the level of involvement you require.

All-Inclusive Service

Training and Workshops

Ayming offers customized training services focused on the latest SR&ED trends and updates for your team. The training service is very flexible, and can be conducted either onsite or by webinar. It can also be adapted to an audience size ranging from a few people to hundreds.

À la Carte Services (pay only for what you need)

This service allows more experienced companies to call on Ayming’s expertise on specific issues. Thus, we offer: Technical Writing, Financial Preparation and Forms Production, Quality Control of Claim to Maximize Opportunities and Audit Stimulation/Assistance. Our À la Carte Services can be a great fit for companies who want the ability to customize the services they receive. Additionally, these companies get support in specific areas of the claim process.

SR&ED Express Service

This is a new, exclusive, and unique offer focused on supporting start-up and early-stage innovators. Our streamlined-in-days claim delivery process guarantees that a strong, maximized, and defendable SR&ED claim is completed and delivered in few days. This service is focused on supporting companies who are still in the early process of getting established and could use the extra support.

Unlike larger firms who would typically turn away smaller files, Ayming sees the value in your innovation and future growth potential. No company is too small for us. We set you up with a 3-year action plan to support you through the critical next phases of the SR&ED program. We then ensure that you emerge with a strong SR&ED track record by meeting all standards and expectations from the CRA.

Why Choose Ayming as your SR&ED Tax Credit Partner?

Ayming secures $1.5 billion annually for its clients, with a 98.5% success rate. Here are just a few more reasons why partnering with Ayming can provide substantial financial benefits to your company:

- 1,100+ R&D experts serving our clients globally.

- We provide full support in the case of a SR&ED audit or review, at no extra charge.

- Ability to service companies of all sizes, including early-stage and start-ups with our proprietary SR&ED Express offer.

- Ayming Canada’s highly experienced delivery teams boast over 200+ years of combined SR&ED experience. We’ve also got over 50+ years of combined grants experience, meaning you partner with true subject matter experts who are invested in your success.

- With Ayming, clients do not have to wait for the government agencies to process their SR&ED applications in order to receive money immediately. Ayming has an exclusive fund of $150 million. This means we can provide accelerated access to your funding through our attractive financing offer.

- We are able to double the funding we bring to our clients with our combined SR&ED and grant offer.

- Our proprietary artificial intelligence (AI)-driven database of grants provides real time access to thousands of programs. This includes a custom snapshot of all federal and provincial grants currently available to your specific business.

- Readily available references from all industries.

Contact us today!

One of our experts will be in touch shortly.