The 2022 Federal Budget

On April 7, 2022, the Deputy Prime Minister and Minister of Finance, Chrystia Freeland, presented the government’s budget. The budget’s major commitment is directing funding towards affordable housing, economic growth, innovation, clean energy initiatives, and public healthcare.

Budget 2022 announces two significant new initiatives designed to drive economic growth and innovation:

- The creation of a new Canada Growth Fund – a $15 billion public investment fund designed to invest in Canadian businesses and the economy, while attracting lucrative private sector investment.

- The creation of a new Canadian Innovation and Investment Agency, an independent agency whose mission is to help Canadian businesses make investments in new technologies and innovations that will drive growth.

Our perspective on the 2022 Budget on Grants

The Liberal Government has reiterated its commitment to investing in clean growth and innovation with particular focus on sustainable technology adoption. Below are a few notable budget items:

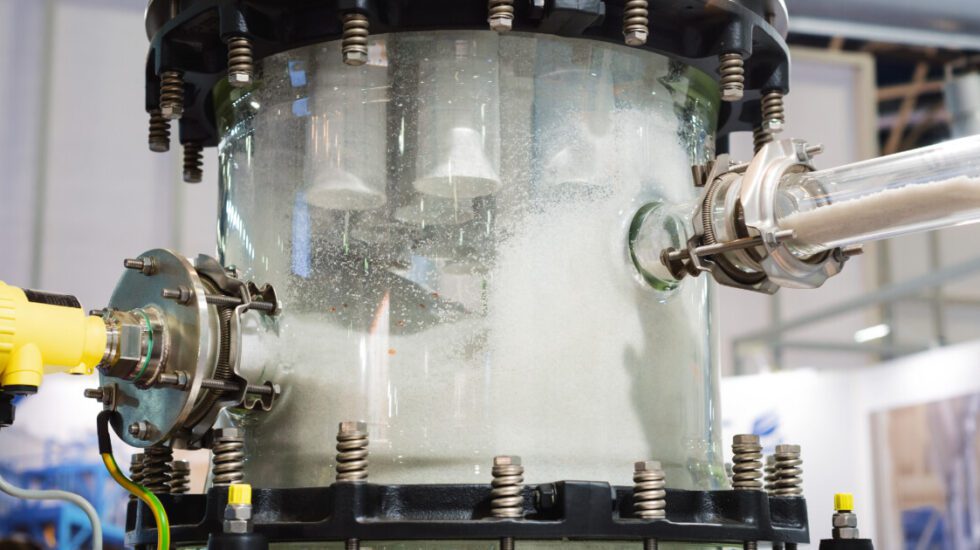

- $2.6 billion towards the Carbon Capture Utilization and Storage (CCUS) tax credit. This program will be delivered in the form of a refundable tax credit ranging from 37.5% – 60% depending on the scope of carbon capture project.

- $2.2 billion over seven years to expand the Low Carbon Economy Fund and support large scale emitters reduce their carbon footprint.

- $469.5 million over six years will be directed to the Agricultural Climate Solutions – On-Farm Climate Action Fund with priority project focuses on nitrogen management, cover cropping and rotational grazing practices.

- The Agricultural Clean Technology Program will be receiving an additional $329.4 million spread over six years.

- $16 million through the Jobs and Growth Fund towards long-term investments that will promote scale-up of Canadian businesses.

- While new investments were not specifically announced for the Canadian Agricultural Partnership Program, federal, provincial, and territorial governments will work together over the coming year to renew the programs under the next agricultural policy framework that begins in 2023.

Relative to previous budgets, there is a lack of new investment for digital technology adoption and direct incentives for training and job creation – however, many of these initiatives will continue to be supported through multi-year programming.

An encouraging takeaway from the 2022-23 budget is the ongoing commitment to the Agri-food sector. Ayming is undoubtedly the incentives leader in the agri-food space, and continued investments from the federal government will shape a fruitful future for the grants and incentives practice.

Our perspective of the 2022 Budget in relation to SR&ED

The Federal Budget 2022 announces the government intends to undertake a review of the SR&ED Program, first to ensure that it is effective in encouraging R&D that benefits Canada, and second to explore opportunities to modernize and simplify it. Specifically, the review will examine whether changes to eligibility criteria would be warranted to ensure adequacy of support and improve overall program efficiency. As part of this review, the government will also consider whether the tax system can play a role in encouraging the development and retention of intellectual property stemming from R&D conducted in Canada. In particular, the government will consider, and seek views on, the suitability of adopting a patent box regime in order to meet these objectives.

With no timeline given for undertaking this review and with little details on what is promised, it is difficult to say how the changes will benefit businesses. However, one of the key lessons of COVD-19 that the government recognizes is that fundamental science and research is vital to our long-term well-being and prosperity. Based on the promises outlined in the Liberal Platform released on Sept 1, 2021, we get some insights on how the government might envision the modernization of the SR&ED program. Below are some of our thoughts:

- Better alignment in eligible expenses to today’s innovation and R&D and make the program more generous for those companies who take the biggest risks, promoting productivity, new inventions, and the creation of good jobs.

- Encouragement of partnerships between government, academia and the private sector, as well as a plan to invest in the freshest, most innovative ideas out there. A promise in the Platform is to establish a Canada Advanced Research Projects Agency (CARPA) as a public-private bridge for research that helps develop and maintain Canadian led technology and capabilities in high-impact areas. This would give access to the much-needed skilled resources for businesses. In the current SR&ED Program, 80% of the payments made to Canadian Universities for services and/or contract labour for support work qualify for SR&ED Tax Credits. One way to encourage the relationship could be to qualify 100% of the payment made to the university for the same services.

- Considerations of “adopting a patent box regime”: Generally, the aim of patent boxes is to incentivize businesses to locate IP in the country by taxing patent revenues at a lower rate from other commercial revenues to incentivise research and development.

The government knows IP is a critical ingredient in helping Canadian businesses reach commercial success. In April 2018, the government launched the Intellectual Property Strategy to help Canadian entrepreneurs better understand and protect intellectual property and also get better access to shared intellectual property. In the current SR&ED Program, IP expenditures are not eligible – perhaps this will become a qualifying expenditure in the future.

The government often uses consultations to solicit feedback on proposed changes to programs, legislation, regulation, practice and operational issues. The budget proposes $2 million to Innovation, Science and Economic Development Canada to launch a survey to assess the government’s previous investments in science and research, and how knowledge created at post-secondary institutions generates commercial outcomes.

Interested in learning more about the 2022 Budget and how it relates to government funding for your business? Contact an Ayming team member today!

Why Ayming?

Call us today to gain a comprehensive understanding on all the government funding opportunities available specifically to your company, you may be surprised at the funding options we help you uncover.

Ayming secures $1.5 billion annually for its clients, and here are just a few more reasons why partnering with us can provide substantial financial benefits to your company:

- Over 35 years’ consulting experience in tax credits and grant funding.

- Global presence in 15 countries with over 20,000 happy clients.

- Ayming is the first Canadian company to establish a grant practice nationally.

- Our proprietary artificial intelligence (AI) driven database of grants provides real time access to thousands of programs, including a custom snapshot of all federal and provincial grants currently available to your specific business.

- We provide full support in the case of a SR&ED audit or government review, at no extra charge.

- With Ayming, clients do not have to wait for the government agencies to process their grant and SR&ED applications in order to receive money immediately. Ayming has an exclusive fund of $150 million which provides accelerated access to your funding through our attractive financing offer.

- No risk, success-fee remuneration available.

- Ayming boasts a 98.5% success rate on all government claims submitted.

Contact us today!

One of our experts will be in touch shortly.

No Comments