SR&ED Tax Credits: Overcoming Technological Uncertainties in Design and Manufacturing Combustion Systems

When it comes to design and manufacturing combustion systems, companies often face significant technological uncertainties. These challenges, however, present opportunities to qualify for Scientific Research and Experimental Development (SR&ED) tax credits. Here are some key areas where SR&ED tax credits can be leveraged:

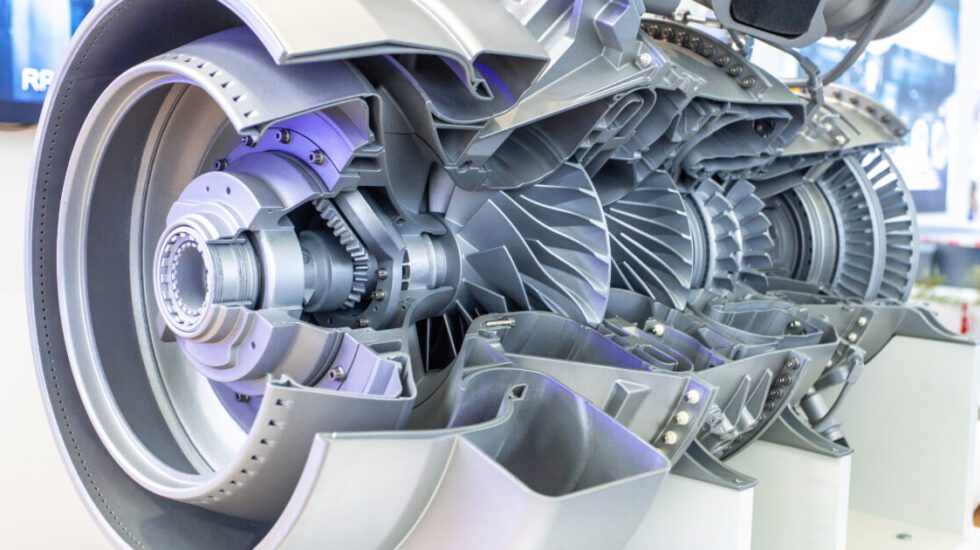

Development of Innovative Combustion Technologies

Technological Uncertainty: Developing novel combustion technologies comes with uncertainties regarding performance, efficiency, emissions characteristics, and scaling up for commercial use.

SR&ED Activity: This involves conducting experiments, simulations, and prototype testing. All of it helping to tackle uncertainties related to combustion efficiency, emissions control, and overall performance.

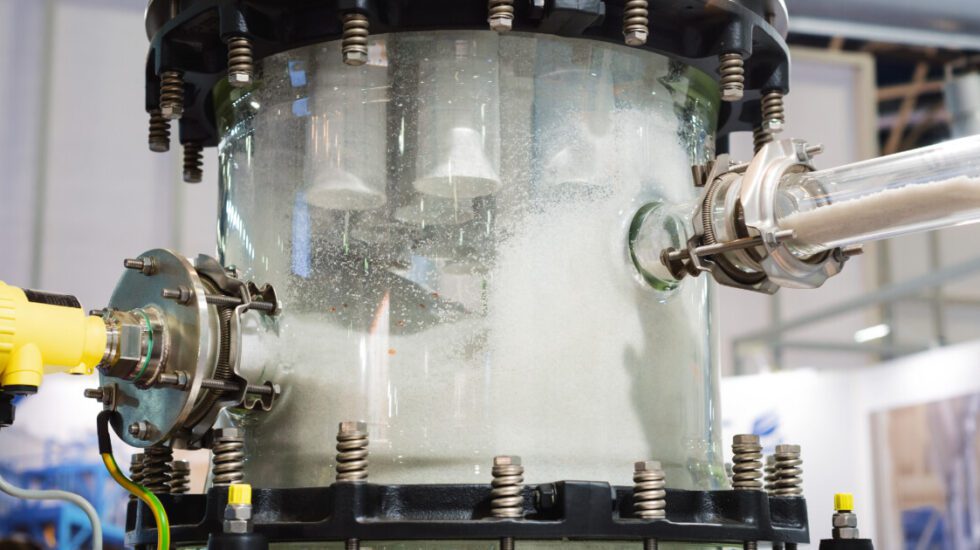

Optimization of Combustion Processes

Technological Uncertainty: Enhancing the efficiency of combustion systems involves uncertainties in optimizing parameters like fuel-air mixture, combustion temperature, and pressure.

SR&ED Activity: Designing and conducting experiments to optimize combustion processes, exploring various materials for components, and testing configurations to boost efficiency and reduce environmental impact.

Emission Reduction and Compliance: Design and Manufacturing Combustion Systems

Technological Uncertainty: Meeting stringent emission standards requires innovative solutions. This leads to uncertainties in developing and implementing technologies that reduce emissions while maintaining system performance.

SR&ED Activity: Researching and testing emission reduction technologies, refining control systems, and conducting experiments to ensure compliance with environmental regulations.

Advanced Materials and Manufacturing Techniques

Technological Uncertainty: Introducing new materials or manufacturing techniques in combustion system design can bring performance, durability, and cost-effectiveness uncertainties.

SR&ED Activity: Researching and experimenting with advanced materials for components like burners and heat exchangers, and adopting innovative manufacturing processes to improve efficiency and longevity.

Integration of IoT and Automation

Technological Uncertainty: Incorporating Internet of Things (IoT) technologies and automation into combustion systems for real-time monitoring and control presents uncertainties in connectivity, reliability, and system integration.

SR&ED Activity: Developing and testing IoT-enabled sensors, control algorithms, and automation systems to enhance the performance, safety, and efficiency of combustion systems.

Energy Recovery Systems

Technological Uncertainty: Implementing energy recovery systems to harness and utilize waste heat introduces uncertainties regarding the efficiency and reliability of these systems.

SR&ED Activity: Researching and experimenting with energy recovery technologies, conducting feasibility studies, and optimizing the integration of these systems into combustion processes.

The Importance of Documentation for SR&ED Claims

For companies engaged in the design and manufacturing of combustion systems, documenting R&D activities is crucial. This documentation should highlight the technological uncertainties encountered and the steps taken to address them. Thorough documentation is essential when applying for SR&ED tax credits, ensuring that companies can fully leverage the available funding opportunities.

By understanding and addressing these technological uncertainties, companies can not only improve their combustion systems but also take full advantage of SR&ED tax credits, ultimately fostering innovation and growth.

Contact Ayming Canada

Ready to maximize your SR&ED tax credits and funding opportunities in design and manufacturing combustion systems? Contact Ayming Canada today. Our team of experts is here to help you navigate the complexities of SR&ED claims and ensure you receive the full benefits your innovative projects deserve. Reach out to us now to start optimizing your R&D investments

Contact us today!

One of our experts will be in touch shortly.

No Comments