Advancing Automation Technology: Navigating Technological Uncertainties with SR&ED Tax Credits

As automation technology continues to evolve, pushing the boundaries of what machines can do independently, numerous technological uncertainties emerge. These challenges present unique opportunities for innovation. Scientific Research and Experimental Development (SR&ED) tax credits are vital in supporting companies that dare to solve these complex problems. Let’s delve into the various uncertainties faced by automation companies and how SR&ED tax credits can be leveraged to foster groundbreaking advancements.

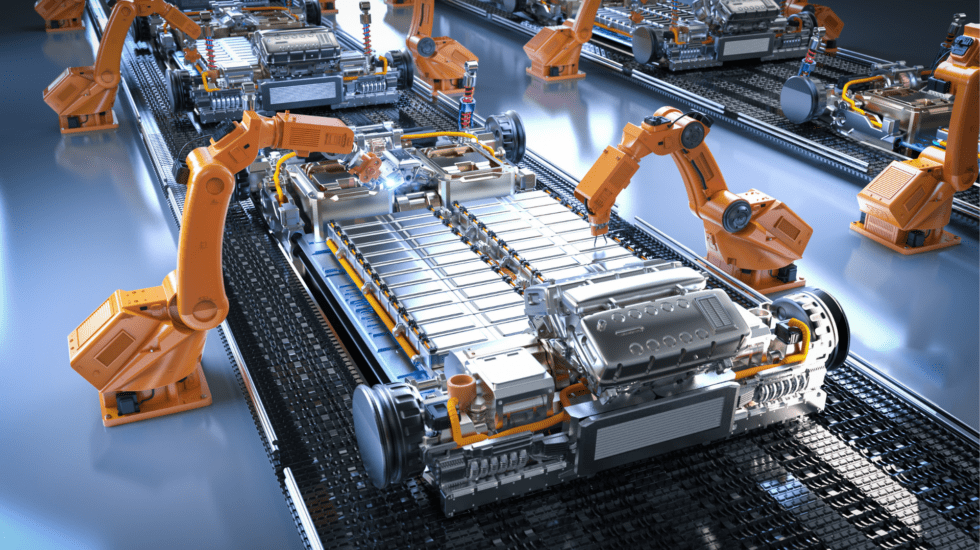

Enhancing Adaptability and Flexibility

Automation systems must be capable of adapting to environmental changes autonomously. Whether it’s modifying production processes in response to design changes or adjusting to volatile market demands, the challenge lies in developing systems that can respond without human intervention. SR&ED could support the exploration and development of these adaptive solutions.

Integrating with Legacy Systems

A significant challenge in automation involves integrating modern technologies with older, legacy systems. The technological uncertainty here is how to create seamless compatibility without disrupting existing operations. SR&ED tax credits can encourage R&D efforts to bridge this technological gap, facilitating smoother transitions in industrial settings.

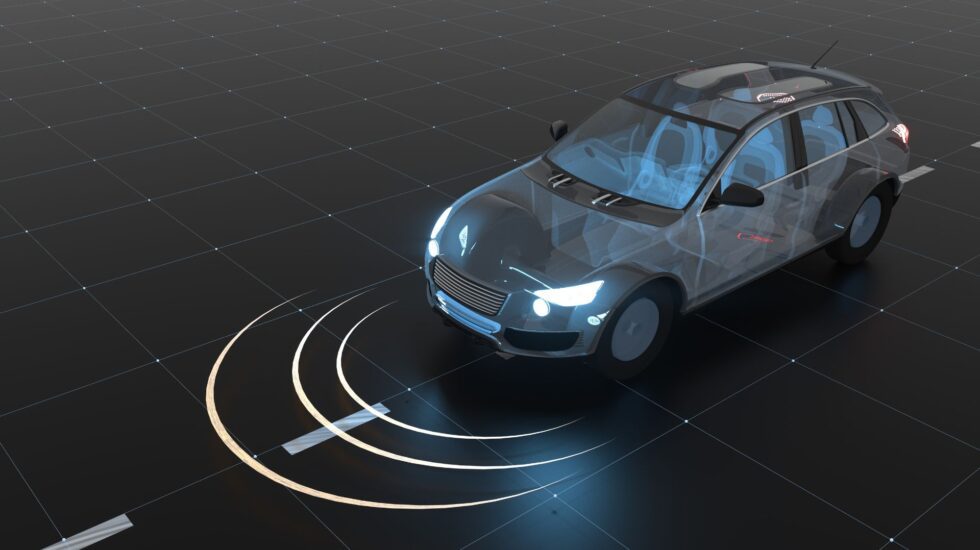

Improving Sensing and Perception: Automation Technology

For automated systems like drones or autonomous vehicles, the ability to accurately perceive surroundings is critical. Differentiating between minor obstacles and serious hazards requires advanced sensing technologies. The development of these sophisticated systems, capable of real-time, high-speed processing, could qualify for SR&ED incentives.

Advancing Decision-Making Capabilities

Automation systems often need to make rapid decisions based on complex data. Enhancing these decision-making processes involves significant technological uncertainty, particularly in ensuring safety and reliability. SR&ED could provide a framework for funding these essential innovations.

Enabling Learning and Adaptation

Incorporating machine learning into automation allows systems to adapt over time to their environments. However, designing these systems for effective and reliable learning presents notable challenges, especially under variable conditions. SR&ED tax credits could support the development of these intelligent systems.

Fostering Human-Machine Collaboration

As machines become more autonomous, the interaction between humans and machines must be optimized for safety and efficiency. Determining the best methods for this collaboration involves considerable uncertainty, making it a potentially prime area for SR&ED projects.

Securing Automated Systems

With the rise of IoT (Internet of Things) and interconnected devices, securing automation systems against cyber threats is more crucial than ever. Developing robust security measures to protect these technologies could be supported by SR&ED, as companies work to mitigate these risks.

Setting Standards and Ensuring Interoperability

As new automation technologies emerge, standardization and interoperability become significant concerns. SR&ED tax credits could aid in the research required to establish industry standards and ensure compatibility across diverse systems and devices.

Addressing Ethical Considerations

Finally, as automation systems take on more decision-making roles, ethical considerations become increasingly important. Research into developing ethical guidelines and frameworks for AI decisions in automation is an area where SR&ED could provide support.

Embracing SR&ED for Automation Excellence with Ayming Canada

For companies at the forefront of automation technology, SR&ED tax credits offer substantial support for tackling these technological uncertainties. Consulting with a SR&ED expert like Ayming Canada can help ensure that all eligible activities are correctly identified and claimed, maximizing the potential benefits and driving innovation.

To learn more about how SR&ED can support your automation projects, or to check your eligibility for these incentives, contact us today. Let’s transform the future of automation together, backed by the power of SR&ED!

Contact us today!

One of our experts will be in touch shortly.

No Comments