Navigating Technological Uncertainties: How Broad Manufacturing Benefits from SR&ED Tax Credits

In the vast field of broad manufacturing, encountering technological uncertainties is almost a given due to the continuous push for innovation and efficiency. The Scientific Research and Experimental Development (SR&ED) program, Canada’s most significant federal tax incentive for R&D, is designed to encourage businesses across all sectors. This includes embarking on technological exploration and advancement in broad manufacturing. Let’s delve into the various areas of technological uncertainties in broad manufacturing and illustrate how SR&ED tax credits can be a catalyst for groundbreaking solutions.

Pioneering Material Development and Processing

Manufacturers often strive to develop new materials or innovative processes to enhance product characteristics. This can include strength, durability, or sustainability. These efforts usually involve high degrees of uncertainty about whether and how the objectives can be achieved, typically making them ideal candidates for SR&ED tax credits.

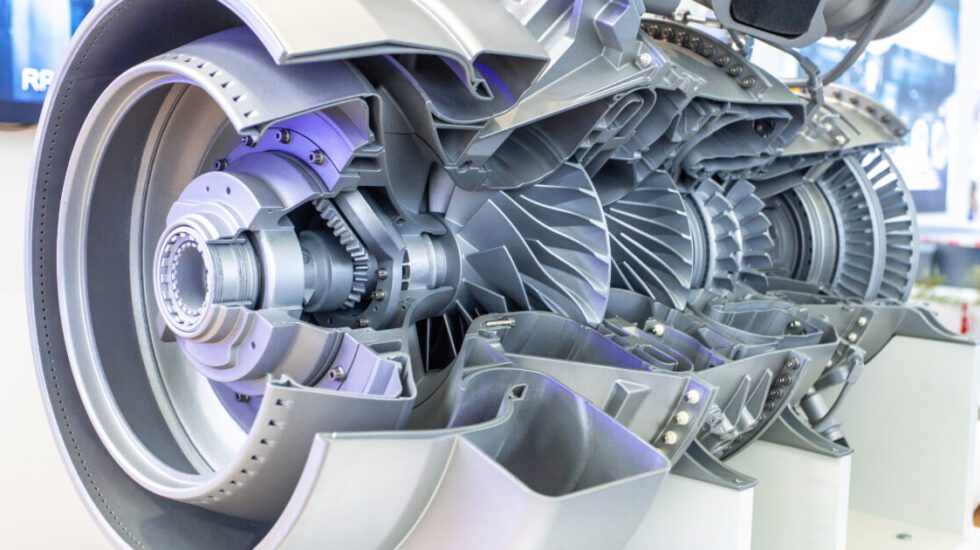

Innovating Machinery and Equipment

The development or significant enhancement of manufacturing machinery and equipment frequently entails tackling uncertainties. Common uncertainties are typically related to scalability, precision, and technology integration. SR&ED can support these ventures, providing financial incentives to overcome these challenges.

Refining Manufacturing Processes

Efforts to enhance manufacturing efficiency, reduce waste, or achieve superior precision present significant technological hurdles. Experimentation with new processes, technologies, or techniques to attain these goals is often a core aspect of SR&ED activities.

Advancing Product Development: Broad Manufacturing

Creating new products or significantly improving existing ones involves numerous technological uncertainties, particularly concerning functionality, performance, and manufacturability. SR&ED tax credits can provide incentives for such innovative product development endeavors.

Addressing Environmental and Sustainability Challenges

Manufacturing processes are increasingly being scrutinized for their environmental impact. Efforts to reduce emissions, conserve water, and minimize waste involve exploring unknown technological territories, supported by SR&ED incentives to foster eco-friendly innovations.

Integrating Automation and Robotics

The implementation of advanced automation and robotics in manufacturing processes often includes uncertainties around system integration, performance optimization, and quality consistency. SR&ED tax credits can be pivotal in supporting these technological advancements.

Enhancing Quality Control and Testing

Developing new methods or improving existing procedures for quality control and testing can be fraught with technological uncertainties. This includes the creation of innovative instruments or methodologies, a process often supported by the SR&ED program.

Developing Proprietary Software

Manufacturing often involves bespoke software solutions to enhance processes, which can pose uncertainties in functionality, integration, and performance. SR&ED can provide a framework for recouping some of the costs involved in developing these software solutions.

Leveraging SR&ED for Manufacturing Innovation

For broad manufacturing companies, the SR&ED program can not only offer financial relief but it also encourages a culture of innovation and technological risk-taking. Documenting the process of hypothesis, experimentation, and results is crucial for successful SR&ED claims. That’s where our significant expertise with SRED tax credit claims matters most.

To learn more about how your broad manufacturing operations can benefit from SR&ED tax credits, or to evaluate your eligibility, contact Ayming Canada today.

Contact us today!

One of our experts will be in touch shortly.

No Comments