Elevating Aerospace Innovation: Leveraging SR&ED Tax Credits in Aerospace Manufacturing

In the high-stakes field of aerospace manufacturing, pushing technological boundaries is not just an option—it’s a necessity. Scientific Research and Experimental Development (SR&ED) tax credits play a crucial role in supporting these ambitious endeavors by offsetting the inherent risks associated with exploring uncharted technological territories. Let’s discover the key areas of technological uncertainty in aerospace manufacturing and how SR&ED tax credits can fuel groundbreaking research and development.

Advancing Material Science in Aerospace

The development and enhancement of advanced materials, such as carbon-fiber composites, are central to advancing aerospace technology. Achieving targeted properties like optimal weight, enhanced strength, and superior thermal resistance involves significant uncertainties. SR&ED tax credits could support the experimental development needed to overcome these challenges.

Innovating in Aerodynamics and Propulsion

Creating new aircraft designs, propulsion systems, and flight control technologies is fraught with unpredictability. The SR&ED program can provide a pathway for funding these types of innovations. This is particularly true where the outcomes are uncertain but the potential for revolutionary breakthroughs is substantial.

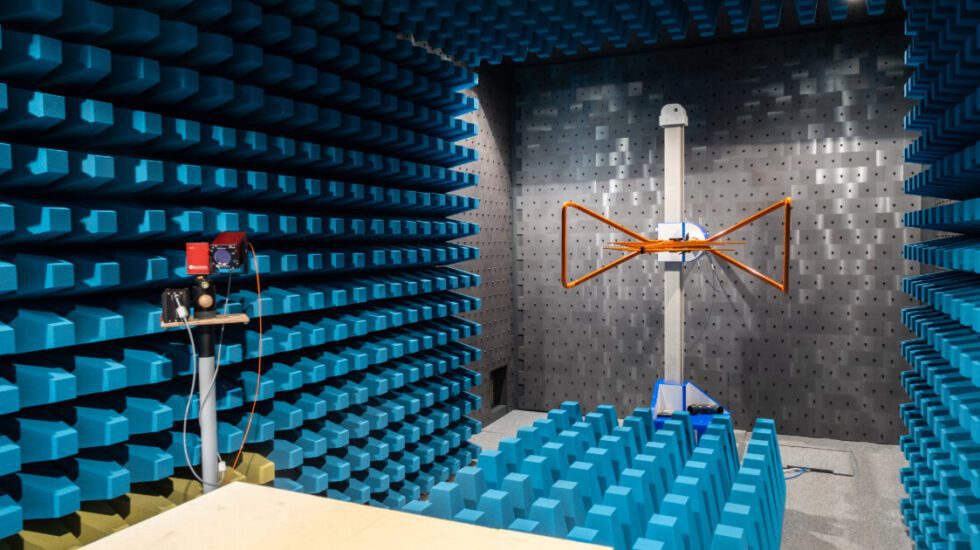

Integrating Cutting-Edge Digital Systems: Aerospace Manufacturing

As aerospace manufacturing firms integrate new digital technologies, sensors, and automated systems into aircraft, they encounter various uncertainties. Particularly regarding safety, reliability, and system interoperability. SR&ED tax credits can encourage the exploration of these digital innovations, supporting efforts to integrate advanced technologies safely and effectively.

Pioneering Manufacturing Processes

The adoption of novel manufacturing techniques, such as additive manufacturing or innovative joining methods, often introduces unexpected challenges. SR&ED tax credits could be instrumental in fostering the development of these new manufacturing processes, enabling companies to experiment with and refine these techniques.

Addressing Environmental Challenges

Developing technologies to reduce emissions and noise from aircraft presents considerable uncertainties, especially when aligning with stringent environmental regulations without compromising performance. The SR&ED program could support R&D activities that aim to resolve these critical issues, contributing to more sustainable aerospace manufacturing solutions.

Ensuring Robust Systems Integration

In aerospace manufacturing, the integration of complex systems poses significant risks. Ensuring compatibility and functionality among new components is a major challenge, supported by SR&ED as companies work to ensure seamless system integration.

Powering Aerospace Advancements with SR&ED

The aerospace sector’s relentless pursuit of innovation is well-matched by the SR&ED program’s goal to encourage technological development in the face of uncertainty. For aerospace manufacturing companies, leveraging SR&ED tax credits means not only advancing the frontiers of aerospace technology but also maintaining a competitive edge in a rapidly evolving industry.

To find out more about how SR&ED tax credits can propel your aerospace manufacturing projects or to assess your eligibility for these incentives, contact us today. Let’s reach new heights together, powered by innovation and supported by SR&ED!

Contact us today!

One of our experts will be in touch shortly.

No Comments