Maximizing Cleantech Investment Tax Credits: Unlocking Funding Opportunities for Canadian Businesses

With the Canadian government’s commitment to achieving net-zero emissions by 2050, businesses across the nation are encouraged to invest in clean technology. As part of this initiative, several Cleantech Investment Tax Credits (ITCs) are now available. These Cleantech investment tax credits offer Canadian companies the opportunity to support environmental sustainability while benefiting financially. These refundable ITCs are designed to help businesses manage the capital costs of investing in clean energy and technology, ultimately aiding Canada in meeting its global climate commitments.

Cleantech ITCs Available to Canadian Businesses

The Cleantech ITCs address various aspects of clean energy and technology. They support investments in renewable energy, green manufacturing, electric vehicle supply chains, and more. Let’s break down the primary credits available and their benefits.

1. Clean Technology ITC (Refundable Up to 30%)

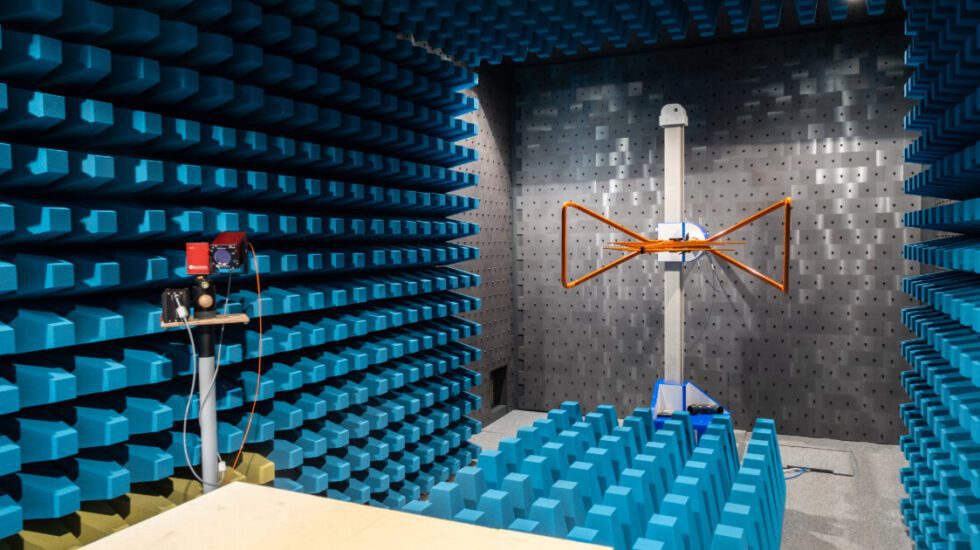

This ITC applies to clean technology property used for energy generation or zero-emission vehicles. Canadian corporations, including real estate investment trusts (REITs), are eligible. Investments covered include equipment for generating energy through solar, wind, water, and other renewable sources. It also includes low-carbon heating systems and non-road zero-emission vehicles.

2. Clean Electricity ITC (Refundable Up to 15%)

Available as of April 2024, this credit applies to projects involving clean electricity systems that began construction after March 27, 2023. Eligible investments support both new projects and refurbishment of existing facilities using solar, wind, geothermal, and other renewable technologies. Additionally, the Clean Electricity credit supports fossil-fuel-free electricity storage and transmission infrastructure.

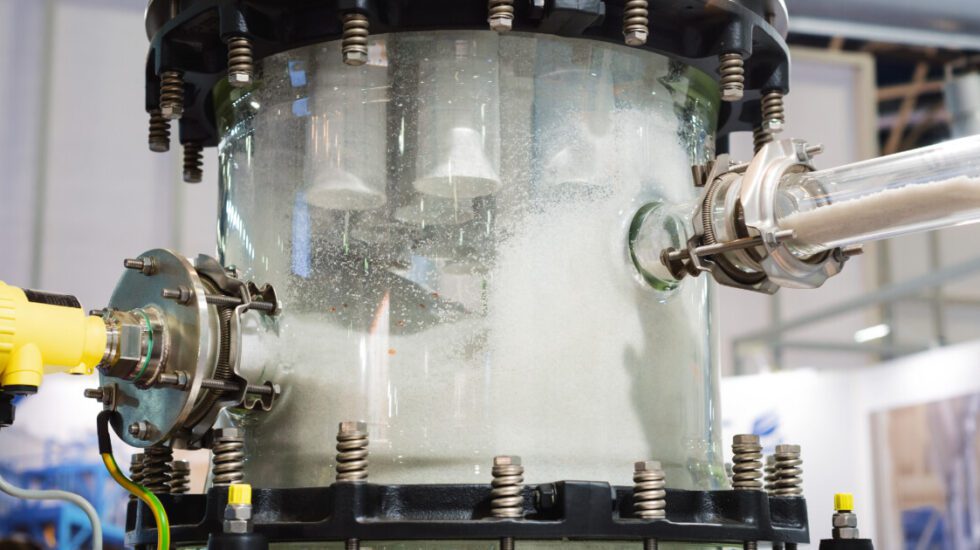

3. Clean Technology Manufacturing ITC (Refundable Up to 30%)

Available for use starting January 2024, this Clean Technology ITC supports investments in manufacturing machinery and equipment used in zero-emission technologies. Eligible investments focus on critical areas. These include renewable energy conversion and storage, critical mineral extraction, and recycling processes.

4. Electric Vehicle Supply Chain ITC (Refundable Up to 10%)

Exclusive to Clean Technology Manufacturing ITC claimants, the Electric Vehicle Supply Chain credit is designed to support capital costs for infrastructure tied to the EV supply chain. Investments may include facilities for electric vehicle assembly, battery production, and cathode active material production.

5. Carbon Capture, Utilization, and Storage (CCUS) ITC (Refundable Up to 60%)

This tax credit encourages investment in equipment for capturing, transporting, utilizing, and storing carbon. Eligible expenses include costs related to adopting CCUS technologies. These expenses are instrumental in reducing emissions in high-emission industries.

6. Clean Hydrogen ITC (Refundable Up to 40%)

This ITC is designed to foster the growth of clean hydrogen production by offsetting costs for installing eligible equipment. Projects must be acquired and operational after March 2023, with the credit applying to the production of hydrogen through sustainable means.

Why CleanTech ITCs Matter to Canadian Businesses

Cleantech ITCs provide substantial support to help businesses reduce their environmental impact. They also help businesses remain competitive in the global market. Whether you’re already investing in clean energy or are considering opportunities, it’s essential to understand the requirements and options available under each Cleantech ITC. By making the most of these credits, Canadian businesses can reduce capital expenses, improve sustainability, and potentially transform their operations for the future.

Contact Ayming Canada

Ready to take advantage of Cleantech tax credits? Contact Ayming Canada today. Our team of experts specializes in Canadian tax credits and grants. Let us guide you through every step of the application process to ensure you maximize your funding. With our extensive track record of securing millions in funding for clients, we’re confident we can help you achieve similar success. Reach out to us now to explore how Cleantech tax credits can support your business goals and boost your bottom line.

Contact us today!

One of our experts will be in touch shortly.

No Comments