Pioneering Aerospace Innovation: How Aerospace Suppliers Can Benefit from SR&ED Tax Credits

In the competitive landscape of aerospace manufacturing, suppliers are the unsung heroes who push the envelope of technology and innovation. As these companies strive to advance aerospace technologies, Scientific Research and Experimental Development (SR&ED) tax credits can provide essential support. SR&ED tax credits can alleviate the financial burden associated with research and development. Let’s explore the technological uncertainties that aerospace suppliers face and how leveraging SR&ED tax credits can drive their innovative projects.

Exploring New Horizons in Materials Research

Aerospace suppliers often embark on the journey of developing new materials or enhancing existing ones to achieve characteristics. This includes reduced weight, improved strength, and enhanced environmental resistance. The SR&ED program could support these endeavors, recognizing the inherent uncertainties involved in materials science research.

Refining Manufacturing Processes

Innovation in manufacturing processes, whether through the adoption of novel welding techniques or the development of more efficient production methods, is fraught with challenges. SR&ED tax credits could facilitate the exploration and implementation of these advancements, helping suppliers overcome the technical unknowns and improve operational efficiency.

Integrating Sophisticated Systems

The integration of new systems or components into established aerospace frameworks presents significant uncertainties, particularly in terms of compatibility and performance. The SR&ED program could provide incentives for suppliers to undertake these complex integration projects, ensuring the reliability and functionality of aerospace systems.

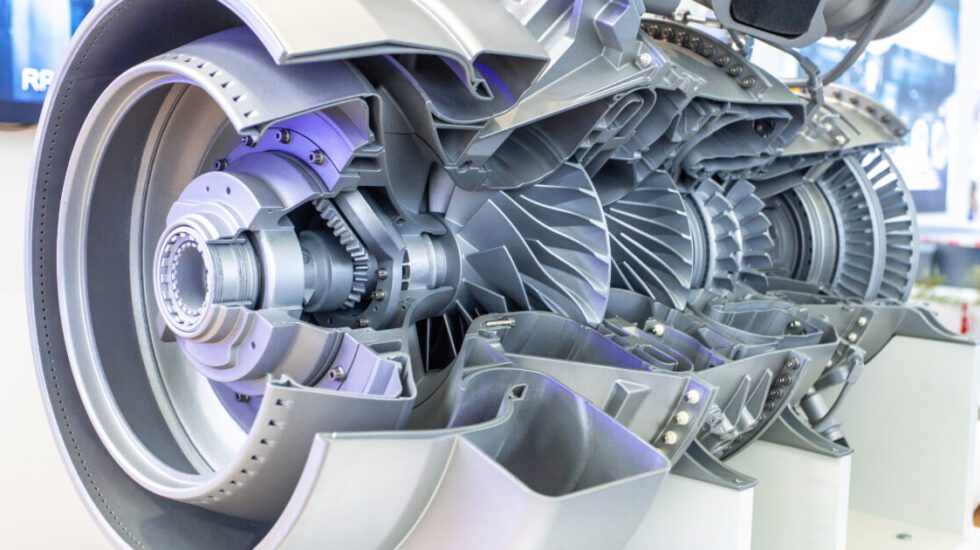

Advancing Propulsion Technology: Aerospace Suppliers

Research into more efficient or environmentally friendly propulsion systems is another area where SR&ED tax credits could play a crucial role. These projects often involve significant uncertainties, particularly when pushing the boundaries of current propulsion technology.

Implementing Cutting-Edge Digital Technologies

The adoption of new software and automation technologies to enhance design, manufacturing, or operational efficiency introduces multiple challenges. SR&ED could support the resolution of these challenges, enabling suppliers to fully integrate innovative digital solutions into their processes.

Addressing Environmental and Safety Challenges

Efforts to meet stringent environmental regulations or to enhance product safety are often riddled with uncertainties. The SR&ED program could acknowledge these challenges, supporting research aimed at reducing emissions, minimizing noise pollution, and improving safety and reliability.

Enhancing Testing and Validation Methods

Developing new testing and validation techniques to ensure the quality and performance of new aerospace components or systems could qualify for SR&ED tax credits. These activities often involve overcoming significant technical hurdles to establish effective and reliable testing protocols.

Navigating SR&ED Claims as an Aerospace Supplier

For aerospace suppliers, understanding and documenting the technological uncertainties encountered during R&D activities is crucial for successful SR&ED claims. This documentation not only supports the claim process but also highlights the supplier’s contributions to advancing aerospace technology.

To learn more about how SR&ED tax credits can support your aerospace supply projects, or to assess your eligibility for these incentives, contact us today. Let’s propel the future of aerospace together, backed by innovation and supported by SR&ED

Contact us today!

One of our experts will be in touch shortly.

No Comments