Identifying Technological Uncertainties in Adhesive Manufacturing

Adhesive manufacturers routinely face complex issues that stem from the need to innovate. Some prevalent technological uncertainties include:

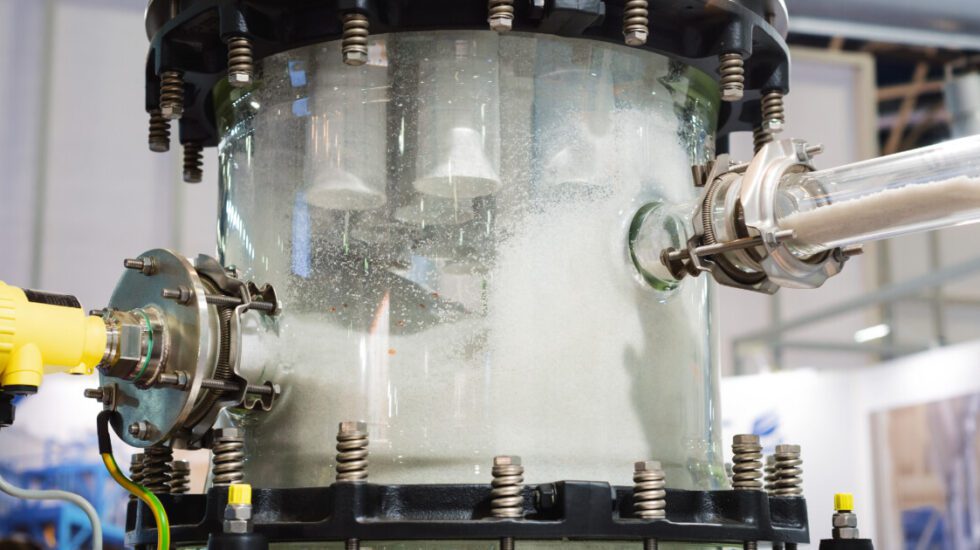

- Formulation Challenges: Achieving the perfect formula that offers specific benefits, such as quicker drying times, superior bonding strength, and resistance to extreme conditions, is a significant challenge. Predicting the behavior of various components and their synergistic effects requires deep scientific inquiry.

- Eco-Friendly Solutions: As environmental standards tighten, developing adhesives that are both effective and sustainable presents a unique set of challenges.

- Adaptation to New Materials: The introduction of novel materials in sectors like automotive and aerospace necessitates the development of compatible adhesive solutions.

- Longevity and Durability: Ensuring adhesives perform consistently over time and under various environmental stressors, like UV rays and moisture, is crucial.

- Innovations in Manufacturing Processes: Scaling production from the laboratory to mass production, while integrating new technologies and automation, introduces multiple uncertainties.

- Industry-Specific Customization: Creating adhesives that meet the stringent regulations of industries such as healthcare and food services is particularly challenging.

- Reusability and Easy Removal: There is a growing demand for adhesives that are not only durable but also removable and reusable, aligning with sustainability goals.

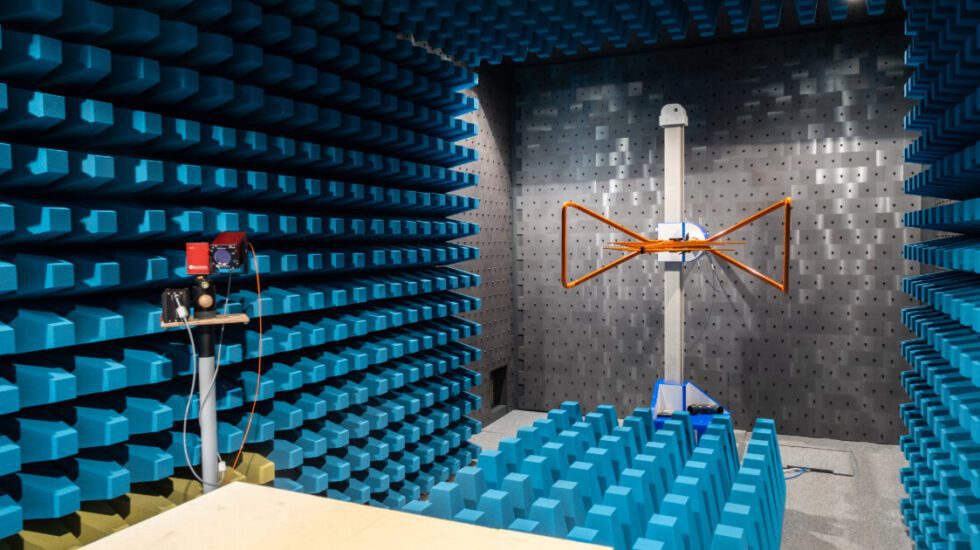

- Advanced Delivery Systems: Developing innovative application methods for challenging environments, such as underwater or space, requires breakthroughs in adhesive technology.

Leveraging SR&ED Tax Credits for Adhesive Manufacturing Innovation

To capitalize on SR&ED tax credits, adhesive manufacturers must engage in systematic research to address these uncertainties. It is crucial to document every experiment, challenge, and outcome thoroughly, as this will form the basis of a successful SR&ED claim.

Consulting with SR&ED Experts

Given the complexity of SR&ED regulations and the potential for significant financial benefits, partnering with an experienced SR&ED consultant is highly recommended. These specialists can help ensure that your company identifies all eligible activities, complies with evolving regulations, and maximizes your claims effectively.

Get Started with SR&ED Today

If you are part of the adhesive manufacturing industry and curious about how SR&ED tax credits can benefit your company, we are here to assist you. Contact us to explore your eligibility and begin harnessing the financial advantages of your R&D activities. Let’s turn today’s uncertainties into tomorrow’s innovations.

Contact us today!

One of our experts will be in touch shortly.

No Comments